It’s true. We are great at budget travel – without a budget. People ask about our travel budget, what it is and how we afford to travel as often and as long as we do. It still surprises me that anyone should care about our finances, but I guess that’s the world we’re in because of the blog and because we’ve been on this round-the-world trip for 4 years. We want to help people live their dreams, sharing how we manage financially and how we budget has to be part of that. We do not set a budget for travel, we never have and never will, let me explain why average gap year travel costs vary enormously and ours is very low despite not budgeting.

We’ve travelled around the world on what seems very little money, while still owning a house in Australia and almost buying another in Romania. It’s pretty unusual. So here I’ll explain how our travel budget works, or how it doesn’t.

This morning my lovely friend Heidi of Wagoners Abroad was asking about how we, and others, budget. I told her that we don’t. I don’t think she believes me.

Heidi says:

” Everyone has a budget! It is how much you can spend each day/week or month…. if your paycheck is $100 then that is your budget… unless you want to be in debt and spend $150…. it is simple. you probably budget or “keep track” of what you are spending or want to spend.”

Another blogging friend, Manf of Renegade Travels doesn’t budget either, he says:

“(I) Never budget but just spend what we need to. I’ve been spending for long enough to know what’s affordable and what’s not. I know it intuitively I suppose.”

I think we’re the same as Manf. We don’t have a paycheck to spend to, we aren’t restricted like that, we simply have a lump sum that we will make last as long as possible, but not at the expense of having a good time.

A long time ago a bloke that I didn’t know from a bar of soap, accused me of setting an unrealistic budget and not doing my research. My money, my system, we do what works for us and I do more research than anyone would believe, although I’m trying to cut down, it wastes a lot of valuable time and energy, The more you obsess over budgets the less time you spend enjoying your trip.

What’s the cheapest way we can do this?

Is always our first thought

First Some Background About Us and Our Finances

- We are not rich, we do not have pots of money nor a significant online income. We don’t have financial support from family, investments or any other business.

- We did not sell our house, that was something suggested by another blogger this week, as one of the ways families like ours manage financially. Some do, some see their mortgage as a financial trap and are better off without it. We still have a very small mortgage on the house we don’t live in, which our tenants cover. That house is our investment.

- We are almost digital nomads. The income we make online almost covers our expenses. This means we can be location independent and earn anywhere we find ourselves. We are not quite at that point yet, after 4.5 years of blogging.

- We usually travel long-term, backpacker-style, for that is what we enjoy. We do not house-sit to save money as a preferred method. Some do, even families

- Sometimes we base ourselves somewhere for a while. When we’re not travelling I’m a full-time mum and educator but I also put as many hours as I can into the websites. Full time travel always leaves us short of time.

- My husband is a chef, not a job you can do over the internet. He works occasionally in London in a top 5 star hotel. He has a UK passport and pays UK taxes. He does not work as we travel, low industry wages and working visa requirements make that impossible.

- Our style of travel costs less than staying at home paying mortgage, utility bills and shopping for pleasure. That is what makes our financial needs low, that is why this works.

Budgeting While Saving To Leave Home and Travel.

While saving for our departure and first year of travel we really cut our spending down to the bone. $30,000 was the travel fund we were aiming for. We saved that amount in a year. Below are some of the methods we used to save.

- Set an at-home budget. Ours was $200/week ( Australian not US) at first, over time I reduced that still more as I got better at being frugal. I took that amount of cash out of the bank every Thursday and that was all I spent, I stopped using cards completely. If I didn’t have the cash, I couldn’t spend it. That figure covered diesel for the car, food, clothes, toiletries, wine, toys, everything we all spend money on every week. ( I include wine because I’m not willing to sacrifice every pleasure in life!) This tight budget was incredibly limiting, I wouldn’t want to live with restrictions while travelling.

- The mortgage and utility bills still need paying, nothing we could do to avoid them, so they weren’t included in that weekly spend. We reduced our consumption of electricity and gas as much as possible, we stopped using air-con completely and found ways to cook more economically.

- If under budget in any week, keep that cash and take out less from the bank the next week. Keep that starting amount constant. Mine was always $200 ( or less, I know we got much lower than that in the end.) Being under budget is not an excuse to splurge.

- All windfalls and bonuses go straight in the bank to grow the travel fund. Never celebrate them by spending.

- Get pleasure out of going without and watching the savings mount up. It does get hard at times. The boredom of not being able to go anywhere gets to me. I’d rather not live that way, but for just a year of mild tedium, we bought our freedom. Boost moral by keeping a chart and watching the savings grow. Have a treat now and then. For us it was coffee and cakes on the Thursday we withdrew the week’s money.

- Boost your income in any way you can, take in lodgers, sell crafts or produce, work longer hours. Put this money straight in the travel fund.

More information on how we saved here.

The Travel Budget For Year 1 of Round The World Travel

We knew that we would have roughly $30,000 in the bank at the time we left Australia. We knew that we wanted to make that money last as long as possible and set the goal at 2 years. At that time we anticipated spending most, if not all, of our time in Asia travelling incredibly slowly.

$30,000 divided by 2, divided by 365 gave us roughly $40 per day. So that is the goal we set ourselves, to see if we could travel as a family of 4, on around $40/day.

We did OK, some countries are cheaper than others, we came in under $50 most of the time. It’s pretty easy to do in the cheaper parts of SE Asia. We’d stay longer in the cheaper parts, speed through the more expensive parts.

We never kept detailed records nor used any budgeting tools, we just use mental arithmetic, my husband has a good head for figures. I don’t feel any need to have a record other than that created by the bank. I don’t see why you’d need to, unless you were writing a book or posts on the subject, which we weren’t.

How We Made Our Travel Budget That Low?

- The children were small, just 6 and 8 years old, they didn’t eat much and we could all share 1 double bed at times. We never took a room with more than 3 beds back then and usually had child-stays-free deals. The cheapest rooms we found were just $12/night in Laos and Thailand, the most expensive $150 in New York, Times Square.

- Sometimes we book room online, sometimes we arrive and knock on doors until we find a room we like at the right price. You can negotiate face to face, you can’t online.

- We ate at regular backpacker type restaurants. Street food would be even cheaper but we like to sit down over meals. To give you an example of costs, a meal, such as pad thai is usually about 30-50 Baht. That’s less than $2 each. We often cut down to 2 meals a day and I lost a lot of weight, which was a good thing. I wasn’t hungry, you get used to smaller portions of healthier food in Asia. Tourist restaurants will have much higher prices, you need to find the right places, look at menus as you walk down the street, see who is charging what and get an idea of what you should be paying.

- Stay longer in the cheaper places, fly through the expensive ones.

- Don’t book tours and excursions, getting yourself there using public transport and ingenuity saves hundreds of dollars. For example, we recently vising Phang Nga Bay in Phuket, Thailand, a tour was around $100 each and there were 5 of us. Instead we hired a boat privately, it cost us under $100 total.

- Be flexible with flight dates, flying on a different date can save you huge amounts of money. Use Skyscanner to check prices by day.

Then Things Changed.

After just 6 months on the road we ended up in the UK because of family illness. That put us on the expensive side of the world and the ticket to get there hit us in the pocket. That 2 year spending plan went out of the window and we just decided to have a good time!

But having a good time doesn’t necessarily mean spending a fortune, it means spending what you need to spend, no more, no less.

We costed out our first year of travel at just under $100 per day. We were happy with that and you can read about how the money stacked up here. That was roughly the same amount we were spending at home ( including mortgage) during our very boring saving period.

It amazes me that single young people class travelling on $50 per day as “budget”. To us that would be a fortune, $200 a day for the 4 of us, twice what we spent.

We took 2 trans Atlantic cruises and visited 4 continents on that $100 a day.

Our Travel Budget Now. Do We Have One?

We no longer have a travel budget of any sort and now, 3.5 years into this round the world trip, our travel style has changed slightly.

We spend as little as possible on things we don’t care about, yet at other times we spend big. We always look for the absolute cheapest deals and find many free things to do, but we’ll happily splurge on an incredible day out for the kids or a special destination.

This is what round the world travel looks like for us now:

- We no longer travel continuously. We have a base in Romania that we return to for months on end. It’s in a beautiful village, life there is amazing and it’s cheap.

- We also return to London regularly.

- When we travel it tends to be a month here, a month there. Sometimes consecutively, sometimes stand alone trips. In 2016 we have visited around 15 countries. 5 were trips of a month or so. We still tend to call ourselves full time travellers because we haven’t been back to Australia since the day we left.

- We are professional travel bloggers so we get invited to luxury hotels as influencers. We don’t pay. If you see us staying somewhere expensive it’s usually work. But not always. This place was my birthday treat, no work on my birthday!

So obviously, different countries require different budgets, Greece cost more than Thailand, Nepal worked out quite expensive and London always hits us in the pocket. Everywhere we go, we simply make sure we spend as little as possible. We don’t shop for pleasure, we only buy what we need. Frugality and minimalism have become habit.

Last time we were in London I wrote a post about how we were having a fun time on one salary and still saving money to travel, that post is here. London is one of the few places we occasionally house sit. With London hotels costing us from £50- £100 pounds per night, it saves us a lot. My husband works as a chef when we are in London or we couldn’t afford to be there.

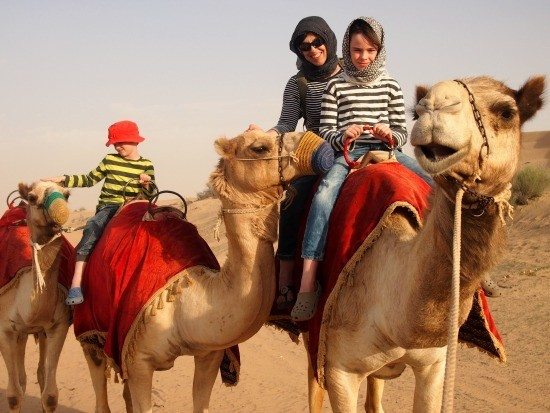

Our spending is based on value for money. OK, so 5 days in Dubai cost us a lot, but the experience was amazing and far more enjoyable than spending an extra few weeks sitting doing not-much, anywhere.

I contradict myself sometimes, quite often probably, because life changes and never stays the same. Sometimes we’re happy to sit still and save money ( that old slow-travel thing) sometimes we need a bit more excitement. Before we left Australia we intended to slow travel the world because that’s what all the family travel bloggers talked about. We found that we really didn’t like that much so we went back to what we love, backpacking.

Setting a Travel Budget Will Spoil Your Fun

What I’m trying to say is that you need to spend enough to make yourself, and your kids, happy. A good friend recently described us as being of above-average happiness. I like that, it made me smile, a lot of that happiness comes from having lovely people like her in our lives. I certainly feel incredibly happy and privileged to be living this life.

Money can buy many of the amazing experiences that make up a lifetime of memories and beating yourself up over sticking to a budget that prevents you grabbing those experiences isn’t conducive to a happy life.

So no, I won’t buy myself a new pair of shoes or a haircut, but I will buy a plane ticket. To some it makes no sense, but to us it does. It’s not a budget I’m sticking to, it’s a lifestyle choice.

We have money in the bank, something we’re really particular about. We never spend right down to the bone. If I want to buy the kids another Lego set or take them to the zoo, I can. But I won’t waste money on things I don’t consider important. If it makes us happy we spend, if it’s something of zero importance to us, we don’t.

No Travel Budget.

So no, we don’t have a budget. I don’t know how much we’re spending at the moment. We’re spending less than is coming in and the savings are increasing, but I couldn’t give you a figure.

We don’t have a budget for our next round of travel, it could be something dirt cheap, to fill time in an enjoyable way, or some big budget bucket list item. We don’t even know where we’re going next, we haven’t thought about it.

We don’t use budgeting apps, spread sheets or even a pencil and paper.

If You Set a Budget, You’ll Probably Spend to That Budget

I have a particular dislike for being asked “What’s your budget?” The last time somebody asked me that question they were trying to sell me a mobile phone. I will always answer “As little as possible”. I know that if I set a budget Mr. Phone Salesman will sell me a phone just 1c under that budget, when the reality is, I could have spent a lot less.

If you set a budget, you will spend to that budget. Which is why people on good salaries always think they need more.

We just have a good time, our way, on as little money as possible and when the money runs short again, we go back to work.

Are We Part of The New Rich?

I think maybe we are.

The “new rich” is a concept I’ve just come across through reading The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich. I know it’s an old book and a best-seller, but I’ve only just discovered it.

We don’t have a business we run remotely on just 4 hours a week, but the book has given me some great take-aways on how to work on the websites more effectively. We do live what many would consider a millionaire lifestyle of travel and free time on minimal annual working hours, and that is who the new rich are. We’re living the life, we’re still working on the income.

Our way is working, for now, we’ve found a balance of work: free time : spending that suits us. If it stops working, we’ll change it all around again.

If you want help with budgeting I’d recommend you’d go and see Heidi ( at the link above) she’s far more organised than I am and a lovely person. We’ll just carry on doing us and set a budget? No way!

Got any questions? Stick ’em in the comments!

If you'd like to hire a car during your stay, use this car rental comparison tool to find the best deal!

We also suggest you take a look at this company to get a quote for all kinds of the more tricky adventure or extended travel insurance.

Try Stayz / VRBO for an alternative way to find rentals on homes/apartments/condos in any country!

We have 2 sons also—now 28 and 31. They grew up in the same family, but have completely different approaches to money from each other. They both had jobs strating at 15, but one is a spender and the other is considerably more frugal.

Yes, our kids are people in their own right. They’re not a product of their parenting. Something that becomes more obvious to me every day and has been obvious since birth with my two!

There was a time in my life, a long time ago, when I wrote down every penny I spent. My mother thought I was insane. We haven’t had a formal budget for over 30 years, but I think maybe that early over the top attentiveness to finances when I was an impecunious student and getting settled in my first job, helped to train me to have at least a subconscious grasp of money flow (in and out). We’ve always managed to live below our means without feeling like we were missing anything. When I grew up I realized what an amazing money manager my mother was, giving us high quality experiences (i.e. music lessons, 2 stints living abroad) while getting her 3 daughters to honestly believe that one pair of shoes at a time was sufficient. (The downside perhaps is my ongoing lack of style and no patience for clothes shopping. Oh well, I’m pretty sure the acquiring style ship has sailed.) I become catatonic when we have to purchase a big ticket item, but my husband has observed that I’ll happily spend money on plane tickets. Do you do anything specific to teach the boys about finances?

No, they just observe us being total skinflints and searching for the best deals on everything. I’m trying to convince Boo that “stuff” doesn’t buy happiness, but he just loves shopping and getting money to do that shopping with. D is very different, totally easy going, no interest in cash. They don’t get pocket money very often,I’m against them waisting money on “junk” so what little they get, they earn. Instead we buy them anything they need, with heavy influence on the word NEED. Although, of course, sometimes they do need more Lego, a new computer game or whatever fun thing they’re craving, I’m just buying them a new game this morning. If something will REALLY mean a lot to them ,I buy it, even if it’s a cuddly monkey from the zoo, as last week. We all love monkey!

I am exactly the same way. I’ve never followed a budget. We spend on what is important and save on what’s not. Simple. I’m proud that my husband and I have created a life of freedom – working for ourselves, educating our children ourselves, and maximizing our happiness. We’re looking hard into buying a second home now because our first is nearly paid off, and sacrificing some things to get that dream is pretty easy. But a budget? No.

Yay, a fellow non-budgeter! It’s all about the freedom Shannon.

Hope you feel better soon! And a budget doesn’t need to be a written spreadsheet — I keep mine in my head just as you do I think. It’s about being aware of what is going out and what is coming in. So many don’t have situational awareness on many levels but especially about spending money. I see people in the US shopping as a social activity and dropping $20 for coffee and a snack daily but they don’t realize how these small things add up. Fine to spend if that is what makes you happy but I don’t think they do — just a lack of awareness there is anything different. And wine/beer/chocolate are part of the basic food groups so MUST be in whatever budget style we use:)))

Yeah, that’s what I mean Kate, it’s lifestyle, a lifestyle of just not wasting money on unimportant things, sure we could go out for coffee every day ( ask yourself why people do that…boredom!) or we could use that money for something we really care about. We don’t have any particularly great memories of that one amazing coffee and cake we had, anywhere.

Love this post! We are currently travelling Australia (we sold our house to go it) and love the travelling lifestyle so much that we never want to stop. We hope to do world travel next. Like you though, we have decided that the only way we can afford to, will be to stop and work and save then travel as long as possible then stop and work again and repeat. I tried a blog (way too time consuming). I’m a home educator too. Plus I think blogging can take away the enjoyment of travel. I then looked in to numerous online work options but they were either dodgy or too hard to do while travelling. So I love hearing how you have made the stop and work, then travel off savings work for your family. Only question I have is – how do you afford to save when staying in London and paying rent, bills, food, etc.. On one income? When we stop travelling to save again I think we will have to live in a caravan at my parents house cos rent in Sydney is crazy and would take almost all our pay check.

There is a link to a post all about that in the post Roslyn. It comes down to lifestyle choices. No car, walk as much as possible, avoid public transport, find free things to do. The blog is VERY time consuming, but I love it, it’s my hobby and brings me joy, so I want to get up in the morning and spend 4 hours on it before the kids get up, I enjoy that. The only time I hate it is when I HAVE to write posts, for money or for sponsored stays or activities, so we just don’t do those any more unless we really want whatever the sponsor is offering. Why don’t you look out for a long term house sit? There are loads in Austraia. I don’t like house sitting but if you’re going to have to sit still anyway for a while it’s great.

Ah, there is a difference between having a budget and tracking your expenses. With my quote that everyone has a budget, you do. It is how much you think you can spend. There is a limit, even if it is unwritten. It doesn’t mean you need to write it down, track it or even keep to it. It is a figure or amount that you think you can use without going into debt.

It varies daily, weekly monthly. We are just like you, we save a bit of money and that is funding our travels. We make a tiny bit on the blog here and there and the longer we make the savings last the better.

In fact exactly as you describe. We are allowed to go over budget and we certainly don’t make decisions on a daily basis. i track expenses on a monthly basis to see where we can make improvements or see where we can splurge the following month. (During our nomadic travel for 10 months in Southeast Asia, I did keep a record on a daily basis, for the sole purpose of sharing expenses with our blog readers. Sometimes I am surprised at the end of the month how far under or over we were. It is like a game for me.

Perhaps the word “budget” means different things to different people. To me it isn’t about tracking.

Thanks for the mention Alyson! I just get the biggest kick out of you and how passionate you are! 🙂

Yeah well, I support my mates Heidi xx

And we still don’t have a budget……

I really am inspired by all that you do for yourself and for your family. I’m glad to know that there are others in the world that live for new experiences and for the freedom from a “budget” or money restraints. After my school loans are paid off I plan to become a part of the “new rich.” Good luck to you and your family! Continue to be rich in all of your shared family moments :).

Hey Mill, I’ll see you on an island somewhere and we can “Blog From Paradise” together!

Hi there-

Just read this post. Such good timing for me to read this from my desk as I continue to dream and save for my family of travel. We are saving right now (3 kids ages 11 and 8-twins) and with jobs and all hoping to be on the road and in the air in two years. I am sending this along to my husband who is a big “budgeter” as I lean more in the direction of living and relating to money as you describe. I know there is a middle ground but great to read that the way I lean can actually work and work happily. Look forward to continuing your posts-

Fran (from Denver, Colorado)

The very best of luck to you Fran and thanks o much for commenting. We do this to help and inspire others, it’s good to know people are reading.